Tracking Your Points & Limited Time Bonus Offers

A look at my Google Sheet and some of the offers I'm excited about now.

Advertiser Disclosure

Some of the credit card offers that appear on this site are from credit card companies from which allwaysaway.com receives compensation if you are approved. Compensation impacts banner placement, but does not impact the articles posted on allwaysaway.com. This site does not include all credit card offers available in the marketplace.

New to credit card points & miles? Start with the mini-course!

👨🏫 Lesson 1: The Value of a Point

On the surface it may seem like every rewards program earns at the same rate of roughly 1 point per penny of spend, so that must mean that every point or mile is worth 1 cent, right? WRONG.

Today you’re getting a supplementary lesson thanks to a question sent in by my former colleague Jorel:

Hi Armand,

Is there a recommended tool you use for tracking credit card points?

My short answer is a Google Sheet, but over the years I’ve tried many free and premium third-party apps and tools. Each of which excel in specific areas and leave other aspects unaddressed. While some tools are better than others, I can’t recommend one over simply creating a spreadsheet to track what’s important to you.

Today, I’ll share my Google Sheet and some commentary on why I track what I track, and we’ll talk through some bonus offers and deals that are currently live so you can maximize point earnings and transfers. In the meantime, send any questions over by replying here or writing us at: [ info.allwaysaway@gmail.com ]

Tracking Your Points

There’s no shortage of tools and apps to track credit card miles and points, but when it comes to tracking your cards, there are three distinct aspects to consider:

Tracking sign-ups to ensure you’re within bank rules (Rules of the Game in Lesson 2)

Tracking monthly and annual offers to ensure you’re utilizing all the perks and credits that your card offers (Fringe Benefits in Lesson 3)

Lastly, tracking the absolute number of points, miles and status across all your loyalty programs.

Over the next few weeks I’ll be testing various apps to address #3, but for now I wanted to share a homemade answer to #1 and #2 above.

Enter the AWA Worksheets Bundle

Available to View Only here. In order to edit, simply make a copy for yourself and feel free to update with your own cards.

The sheet includes 3 tabs:

Transfer Partners (detailed below, note that a green highlight implies a bonus offer is currently available).

CC Log, track your new card sign-ups to stay organized and know when to call in for Retention Offers.

CC Perks, track monthly and annual bonuses from your current card mix.

Retention Offers

Now that you have access to the Worksheets, make a copy and start getting your own cards organized and accounted for. If you have a premium card that renewed within 30 days or will be renewing soon, be sure to utilize all the perks that reset on your anniversary date and start getting ready to use all perks that expire on the calendar year since it’s already mid-October.

If you’re unsure whether you want to renew the card or not, it never hurts to call in and see if there is a retention offer available for you. This may be bonus points, a reduced annual fee, or a spend offer. While most of the time there won’t be an offer, it’s still worth asking.

Transfer Links & Special Offers

American Express: https://global.americanexpress.com/rewards/transfer

🏨 Choice Rewards: 1,000 Points = 1,250 Choice Privileges® (25% Bonus)

—> My take: Consider if you have a specific redemption in mind, but I wouldn’t proactively transfer points.🏨 Marriott Bonvoy: 1,000 Points = 1,250 Marriott Bonvoy Points (20% Bonus)

—> My take: Most likely a skip since I don’t consider Marriott points nearly as valuable as Hyatt. It would require a 40%+ bonus for me to consider.

Capital One:

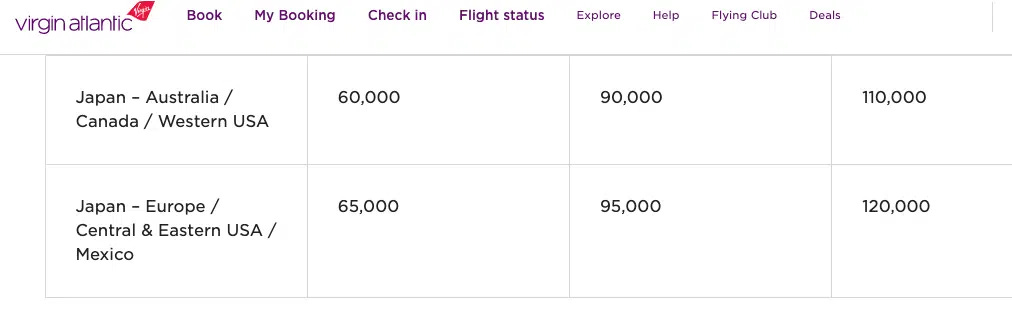

Virgin Atlantic Flying Club: 1,000 Points = 1,300 Flying Club Miles

—> My take: Be careful of pricey fuel surcharges and taxes if you’re planning a trip from the US to the UK. That said, Virgin has a fantastic partner redemption to Japan via my favorite airline (ANA), and this 30% bonus means you’re able to book a roundtrip business class award for roughly 70k to 74k points.

Chase: https://ultimaterewardspoints.chase.com/transfer-points/list-programs

Virgin Atlantic Flying Club: 1,000 Points = 1,300 Flying Club Miles

—> Same as above, so let’s dive deeper.

Here are the standard rates for Economy / Business / First

That’s all I’ve got for now! Next month I will share results of the testing to track awards miles and loyalty points across various programs without having to manually update a spreadsheet. Until then, be sure to reach out with any questions!

❤️ AWA